Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the InsurTech industry. This time, you get to discover five hand-picked cloud computing startups impacting InsurTech.

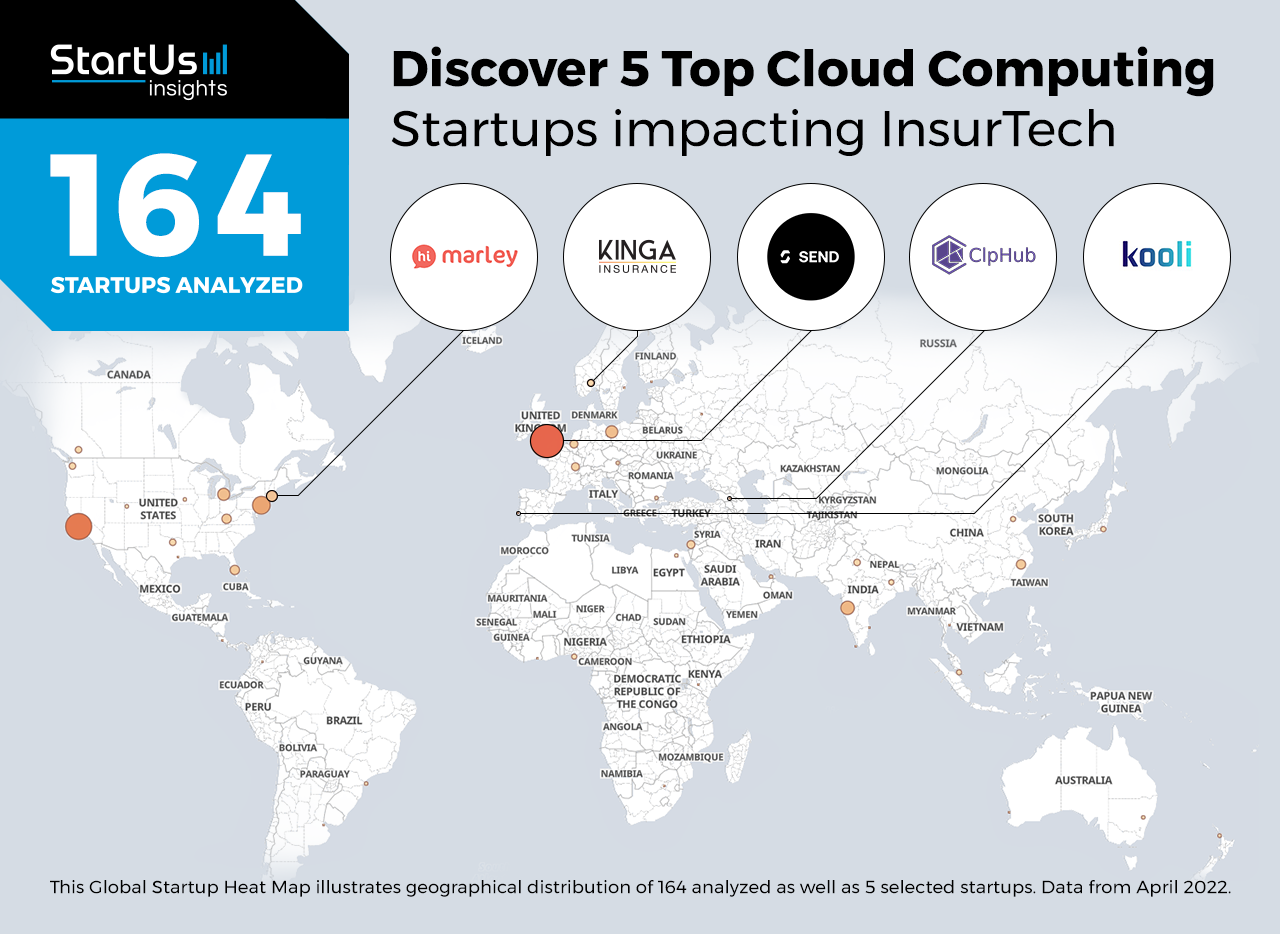

Out of 164, the Global Startup Heat Map highlights 5 Top Cloud Computing Startups impacting InsurTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 164 exemplary startups & scaleups we analyzed for this research. Further, it highlights five cloud computing startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 159 cloud computing solutions for InsurTech, get in touch with us.

ClpHub offers an Insurance Product Development Engine

Founding Year: 2017

Location: Tbilisi, Georgia

Partner for: Policy & Claim Management

Georgian startup ClpHub develops a cloud-based software-as-a-service (SaaS) engine for insurance companies. The engine offers customer overviews, policy and claim management, customer financials, reports, and reinsurance as well as a configuration tool that enables users to build insurance products quickly. Moreover, it integrates a wide range of 3rd party service providers such as Sparkpost, Twilio, and Infobip, among others. This allows insurance and InsurTech companies to reduce the time and cost associated with minimum viable product (MVP) development.

SEND provides a Smart Connected Insurance Platform

Founding Year: 2017

Location: London, UK

Partner for: Scalable Insurance Software

UK-based startup SEND offers a software-as-a-service (SaaS) insurance platform. It allows users to replace legacy policy administration systems without integration issues. Consequently, the platform accelerates advanced application integrations and mitigates data silos. It also automates underwriting to eliminate rekeying, reformatting, and cleansing spreadsheets. Additionally, the platform simplifies asset data management, bordereaux management, and clearance. SEND’s scalable and plug-and-play platform thus allows insurers to save time, track tasks, and streamline processes.

Kinga Insurance creates a Business-to-Business (B2B) InsurTech Platform

Founding Year: 2018

Location: Oslo, Norway

Partner for: Administrative Process Automation

Norwegian startup Kinga Insurance provides a B2B InsurTech platform. It automates manual processes and enables customer self-service to improve operational efficiency. Additionally, the platform allows insurance providers to collaborate with distribution partners, reinsurers, and other stakeholders to improve strategic decision-making. It also supports operation as module-based features as well as offers an end-to-end insurance value chain system, allowing the startup’s client to choose solutions for tailored use cases. This, in turn, reduces the time required to manage policies, claims, financials, and reports.

Hi Marley develops an Insurance Communication Platform

Founding Year: 2017

Location: Boston, USA

Partner for: Policyholder Communications

US-based startup Hi Marley offers AI-based SMS texting software for the insurance ecosystem. Its cloud-based insurance communication platform features an omni-party communications hub that connects carriers and policyholders. The software also allows users to build insurance workflows with message templates, scheduled communications, compliance tools, and transcripts, among others. Besides, its AI performs sentiment analysis to better understand customer feelings instead of just analyzing the text. Hi Marley’s solution thus streamlines policyholder communications, measures daily performance, and reduces calls to resolution.

Kooli facilitates Business-to-Business-to-Customer (B2B2C) Insurance

Founding Year: 2019

Location: Arruda dos Vinhos, Portugal

Partner for: MVP Development

Portuguese startup Kooli develops a B2B2C cloud-based insurance platform. It combines AI, the internet of things (IoT), connected insurance, machine learning, and analytics to automate business processes, prevent fraud, and increase customer retention. The platform allows InsurTech companies to leverage these solutions and build insurance products and services faster. As a result, Kooli enables them to offer novel products and approach newer markets more efficiently, increasing sales.

Discover more InsurTech Startups

InsurTech startups such as the examples highlighted in this report focus on accelerated MVP development, robotic process automation (RPA), fraud prevention, and customer relationship management (CRM). While all of these technologies play a major role in advancing the insurance industry, they only represent the tip of the iceberg. To explore insurance technologies in more detail, let us look into your areas of interest. For a more general overview, download our free InsurTech Innovation Report to save your time and improve strategic decision-making.